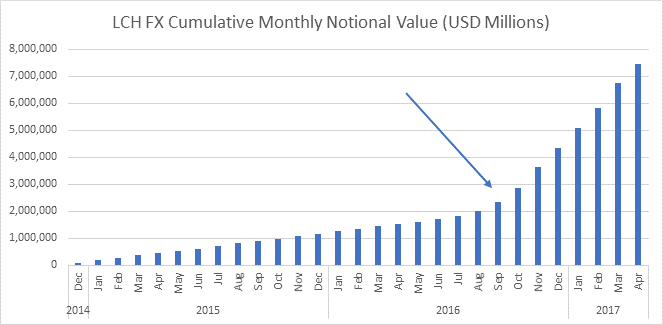

The above graph shows the Cumulative Monthly Notional Value of LCH FX Notional Values.

- From September 1st 2016, the non-cleared margin rules have required many large banks to exchange initial margin on NDFs for the first time.

- As a result has caused a surge in LCH FX volumes in Q4 2016.

- From a margin perspective, NDF’s and forex options are now cheaper to trade via a clearing house than bilaterally, and greater netting is available at a CCP, hence reduced capital requirements.

- Greater Segregation in Credit Risk and reduced exposure to counterparties.

- Emergence of the New FX market place from:

- G20 FX to G20 NDF and ETD

- Bi-Lateral FX Options to Cleared FX Options

- Bi-Lateral G4 to Centrally Cleared G4

There are now more compelling reasons to Clear FX and Sernova is positioned perfectly.

Sernova offers cloud-based clearing services, recreating the infrastructure and service elements of a traditional clearing broker, enabling regional banks to assume direct memberships of CCPs and offer client clearing for regionally significant clients.