Introducing Sernova

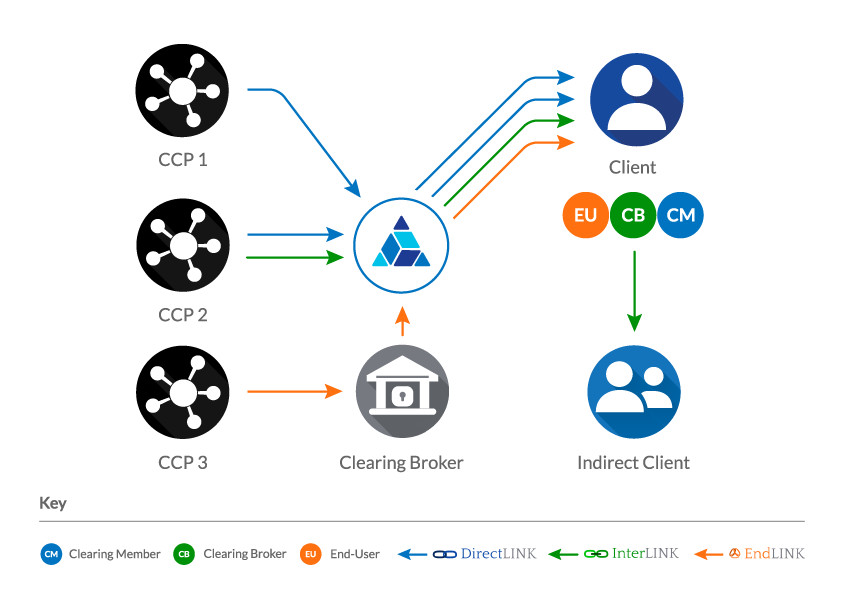

Smart Gateway to Clearing

Sernova Financial is an innovative clearing, collateral and risk management gateway delivering cost-effective, regulatory-compliant, flexible and comprehensive access to clearing services through the cloud.

Self-Clearing. Client-Clearing. Multi-Model Clearing.

Sernova’s post-trade solution recreates the infrastructure of a traditional clearing broker in the cloud, enabling multi asset class self and client clearing across CCPs.

Unique Capabilities

Cloud-Based Service Solution

A cloud clearing service from a non-bank platform, with true data integrity and full Chinese wall segregation.

Scalable Infrastructure

Powered by single-core engine across derivatives, cash and securities, utilised by 86% of global OTC CCPs.

Coverage & Support

Multi-asset (OTC & ETD) offering on global and local CCPs supported by 24/6 client services.

Expertise

Delivered by senior capital market expertise cut across Prime Services, CCPs, Buy-Side and Fintech.

The Regulatory Butterfly Effect

Capital markets are transitioning away from bilateral trading to centralised clearing; unregulated & uncollateralised to standardised & collateralised credit exposures.

A global banking model has emerged which is balance sheet, capital and liquidity constrained – resulting in stricter regulatory compliance, reduced capacity in principal business models and uncertainty of market access.

The result is client and resource management leading to selective client retention and orphaned market participants.

Opportunity

- Rise of regional banks offering global products to regional clients.

- Agency business models (Sponsored principal/ISA-direct).

- Buy and Sell-side firms incentivised to obtain exchange & CCP memberships.

- Reduction of systematic dependence on global banks.